In my 41+ years in and around the financial arena, I have never been more concern about how most in the financial services industry and the financial media tied to their hips, are blatantly ignoring severe economic, social, and political factors that could greatly cause serious harm to many investors and Americans alike. They’re “partying like it’s 1929”. I believe the next few years could be the most challenging for investors in the last half-century!

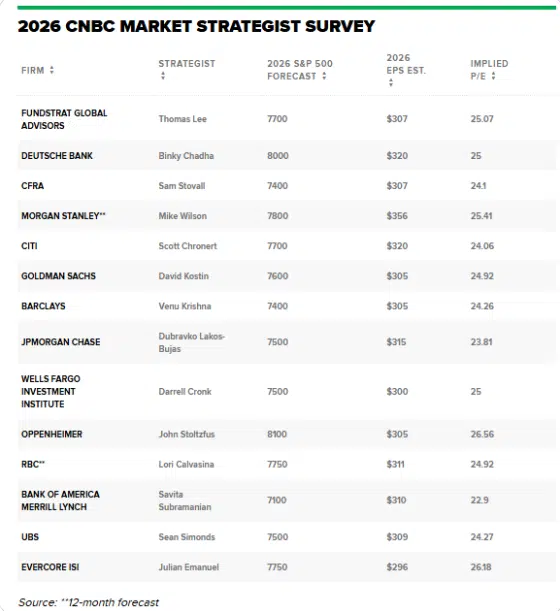

Not one forecaster sees a down year for stocks in 2026 (I do):

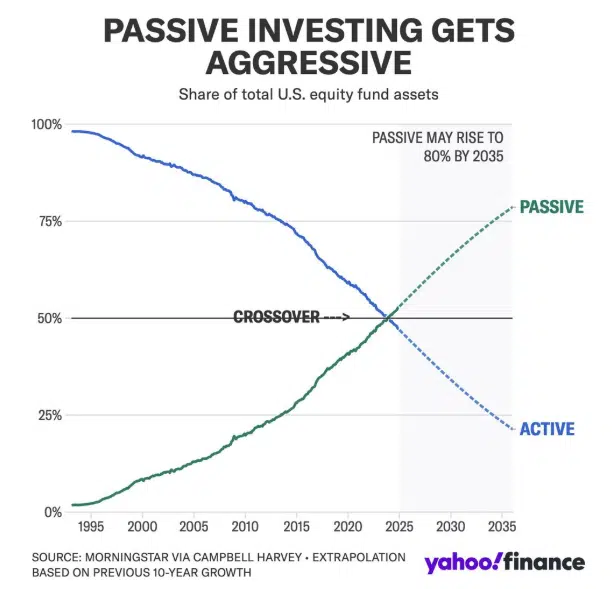

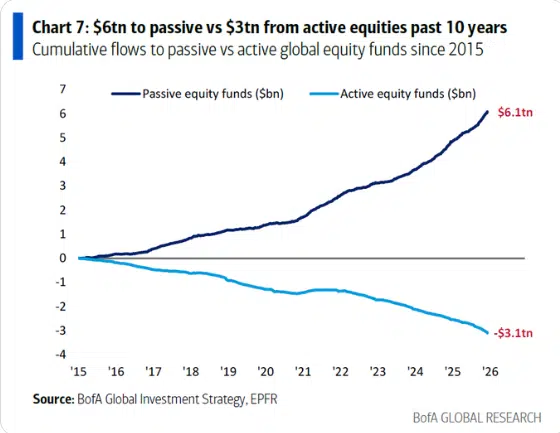

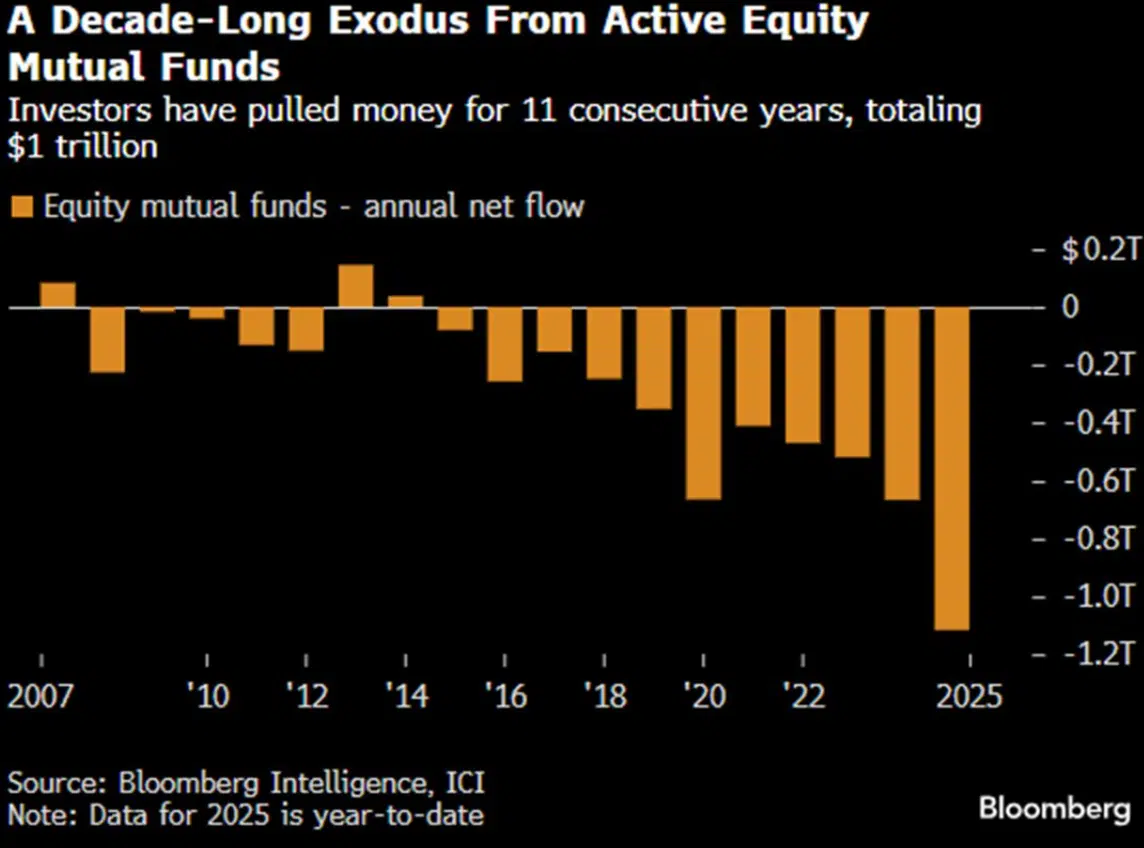

Regarding these two charts above – According to Bloomberg, “around $1 trillion was pulled from active equity mutual funds over the year, marking an 11th year of net outflows, while passive equity exchange-traded funds got more than $600 billion.”

Two factors, disappointing performance and high fees, not only drove this migration but also created additional challenges for actively-managed funds – all this as, on the other side, passive funds remained structurally bound to the index, unable to overweight the handful of mega-cap stocks that drove market gains.

Passive Investing – The Single Greatest Booster To The Stock Market Could Become A Destructive Monster To The Downside.

- Goal: To track the market’s average return over the long term, relying on historical market growth.

- Management: It is largely automated and requires little ongoing research or decision-making after the initial investment, making it a “set-it-and-forget-it” approach.

- Rebalancing: Portfolios are only occasionally rebalanced (e.g., annually) to ensure they stay aligned with the target asset allocation.

Common Investment Vehicles

- Index Funds: Mutual funds that track a specific market index. They are priced once daily after the market closes.

- Exchange-Traded Funds (ETFs): Similar to index funds, but they trade on a stock exchange throughout the day like individual stocks.

- Robo-advisors: Automated platforms that use algorithms to build and manage a diversified, low-cost portfolio of index funds and ETFs based on your risk tolerance and goals.

Key Concern – Fewer active investors are analyzing individual companies. Without active capital, the market has less of a safety net. In a downturn, losses could amplify quickly, and recovery may take longer.

Dark Pools – I’ve spoken about “Dark Pools” knowing most investors and financial advisors are unaware of what they are, and/ or, don’t care. But you should!

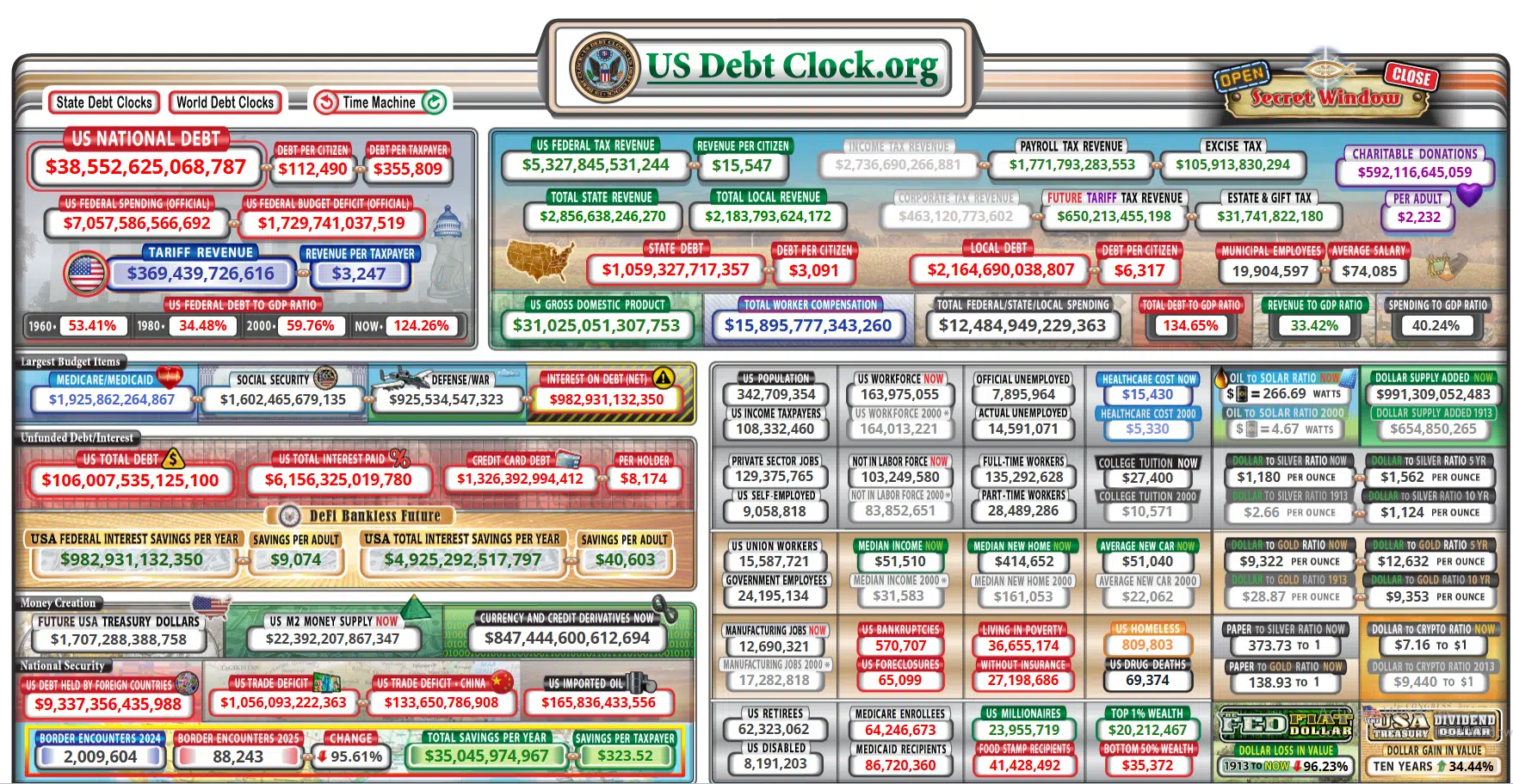

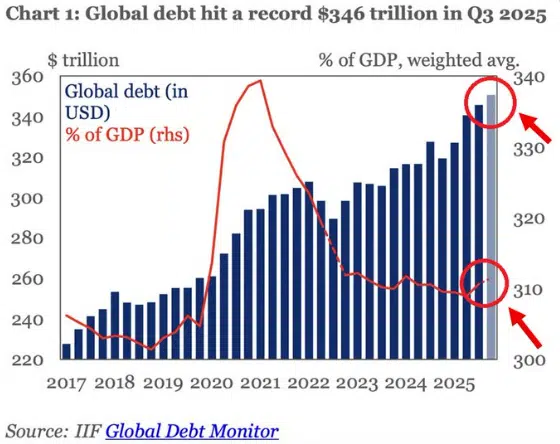

Debt Crisis – It’s no longer a question of if, but most definitely when, decades of ignoring scripture teachings of what large-scale indebtedness can lead to, is upon us.

If “TOUT-TV”(CNBC) even mentions it, you know it’s time to worry:

Retirement Crisis – The retirement crisis in America is characterized by a majority of Americans lacking sufficient savings, rising financial insecurity for older adults, and the potential collapse of Social Security benefits, all compounded by the elimination of private pensions and increased healthcare costs. Factors contributing to this include limited access to workplace retirement plans, insufficient savings for most Americans, and a growing population living longer with less financial stability. This has led to more people needing to work past the traditional retirement age, with many expecting to fall short of their financial goals.

- A Looming Retirement Crisis in America

- U.S. Retirement Crisis: More than Half of Americans Have Less Than $10,000 Saved While Only 0.1% Hold $5 Million Plus

- Addressing the Nation’s Retirement Crisis: The 80%

- The Retirement Crisis: 6 Uncomfortable Truths for Aging Americans

Aging Crisis – A Battle between classes is being greatly compounded by a growing rift between age groups. “Boomers” are facing backlash never imagined by previous seniors.

The idea that “Boomers are to blame” for current societal issues, seen in the “Okay Boomer” trend, points to younger generations feeling economic hardship (housing, debt) and lack of opportunity compared to the post-war boom their parents experienced. While some blame Baby Boomers for self-serving policies (debt, environmental issues) or resistance to change, others argue it’s an oversimplification, pointing to a powerful elite, systemic issues, or a repeating generational blame cycle, with many Boomers themselves feeling unfairly targeted and facing their own financial struggles.

- The Aging And Disability Crisis We Can’t Afford To Ignore

- The Global Aging Crisis Demands Urgent Action Beyond Economics

- Baby boomers have now ‘gobbled up’ nearly one-third of America’s wealth share, and they’re leaving Gen Z and millennials behind.

- 64% of U.S. adults fear financial collapse more than the end of life itself

Infrastructure Crisis – Amazingly, the 2008 financial crisis was suppose to see a large portion of the money creation to save us, go to fix an already crumbling national infrastructure. sadly, much of the money stayed in Wall Street and never made it to Main Street.

- America’s Infrastructure Crisis

- ‘Risk Of Collapse’ Evaluation Ordered For 2 NJ Bridges

- 5 in Philadelphia area to be evaluated for collapse risk

Natural Disaster Costs Crisis – Because of the poor and dangerous infrastructure crisis, natural disasters are causing far more damage than they otherwise would.

* U.S. economic losses from natural disasters reached $218 billion in 2024, topping global average

Political Divide – I believe other than the Civil War, America has never been more politically divided!

- Food Crisis -It’s far worse then most realize.

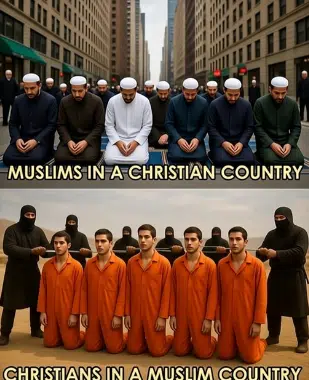

- Islamic Takeover and Dominance

This is not only the most politically incorrect major concern of mine, it’s fast becoming the most alarming!

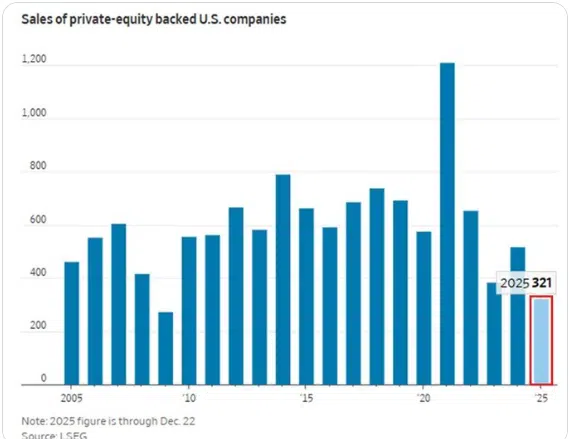

Avoid Private Equity/Credit! – The US private equity market is frozen. Private equity firms have sold 321 companies year-to-date, putting the market on track for its weakest year since 2009. This is despite the number of companies held in private equity portfolios standing at a record 12,899. By comparison, private equity firms sold ~1,200 companies in 2021, nearly 4 times more.

Private equity firms are unwilling to sell companies at lower valuations after buying them at elevated prices, keeping assets off the market, even though plenty of capital is available. As a result, the average holding period, the time between purchase and sale, is now up to nearly 7 years, well above pre-pandemic levels. Private equity firms are stuck!!!

Pull Or Get In The Wagon – The vast majority of American generations were mostly wagon “pullers”. However, for a few decades now, and especially thanks to the Obama and Biden (or whoever was actually running the country at the time), there was not only a great increase in those getting in the wagon, but the valiant wagon “pullers” were being demonized to the point of thinking maybe I should get in the wagon too. Before too long, there won’t be enough willing pullers?

Simply put, I am –

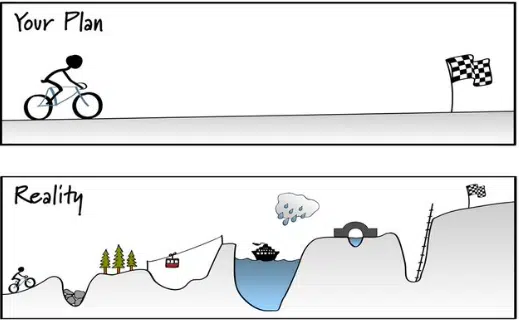

Much of the financial services industry and the financial media tied to their hips, will want you to believe thanks to them, it’s a clear sprint to finish the investing race successfully.

Nothing could be further from the truth!

P.S. In case you still are believing what most of the financial services industry hopes you do, just remember this:

P.S.S. My “Less Is More” Belief and having too much stuff, is expressed in a comical fashion but has so much truth to it: