I have warned you that here in the U.S. and throughout the world, governments that continue to spend like drunken sailors while running up large scale debts, will seek to raise taxes and create taxes hidden as fees, to a point of pure asinine thinking. The Netherlands have started what will end up a mad rush sooner than most folks think.

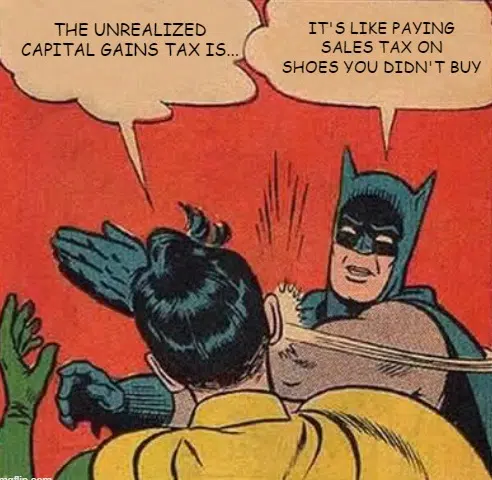

- “Phantom” Income & Liquidity Crises: Critics argue that taxing gains on paper forces investors to sell assets to pay tax bills, even if they haven’t profited in cash. This can cause a “cash poor” situation for individuals with high-value, non-liquid assets (like private business owners or farmers).

- Market Instability & Forced Sales: A tax on unrealized gains could trigger a cascade of forced selling, which might crash stock markets and hit retail investors hard.

- No Tax Refunds for Losses: If an asset is taxed while up, but then crashes, there is no guarantee that taxpayers will get refunds for the taxes previously paid on that “lost” value.

- Constitutional & Administrative Challenges: Opponents argue such a tax violates the 16th Amendment, which applies to income, not accumulated wealth. Furthermore, the IRS would face immense challenges in valuing all assets annually.

- Penalizing Investment & Growth: Critics argue that taxing gains reduces capital for reinvestment, acting as a tax on “optimism and innovation”.

- Wealthy Avoidance Strategy: Proponents point out that the top 1% hold about 40% of their wealth in unrealized gains. The ultra-wealthy often avoid taxes entirely by holding assets until death (using the “step-up in basis” loophole, where heirs inherit assets with a reset cost basis) or by borrowing against their portfolios to fund their lifestyles.

- Addressing Economic Inequality: Taxing these gains is proposed as a way to ensure billionaires pay a higher effective tax rate.

- “Buy, Borrow, Die” Loophole: The wealthy use loans secured by their appreciated, unsold stock to live on, technically generating no taxable income while their wealth grows faster than the economy (Piketty’s r > g).

- US Proposals: The Biden-Harris administration proposed a 25% minimum tax on total income (including unrealized gains) for those with over $100 million in wealth. It of course, died with their losing the election, but it will rise again sooner than most think.

- Netherlands: As of 2026, the Netherlands has implemented a 36% tax on unrealized gains, leading to concerns from investors about the impact on long-term financial planning.

We are also see several states now implementing “Mandatory” (you have no choice) Public Benefit Programs (which is socialism-like). In Massachusetts, customers help pay for others’ electric bills primarily through a mandatory “Public Benefit Charge” on utility bills, which covers low-income assistance programs. This charge has risen, causing concern as it supports state-mandated energy efficiency and affordability initiatives.

That Federal, State, and Local taxes and fees become more widespread.

Proper cash flow and maximum tax efficiency, are the two most important parts of our financial planning process.