Chinese President Xi Jinping has called on the military to “comprehensively strengthen its preparations for war” and ensure that its troops maintain reliable combat readiness. His directive comes just days after significant military maneuvers near Taiwan, a region that Beijing has repeatedly threatened to reclaim by force if necessary:

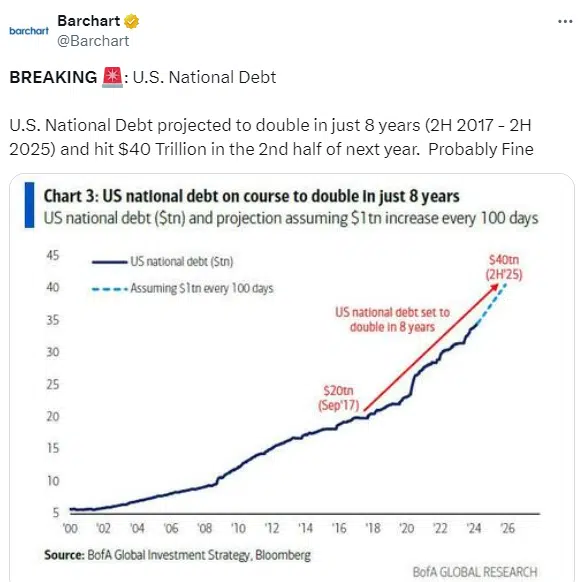

The actual debt amount here

- BRICS – watch this and read this

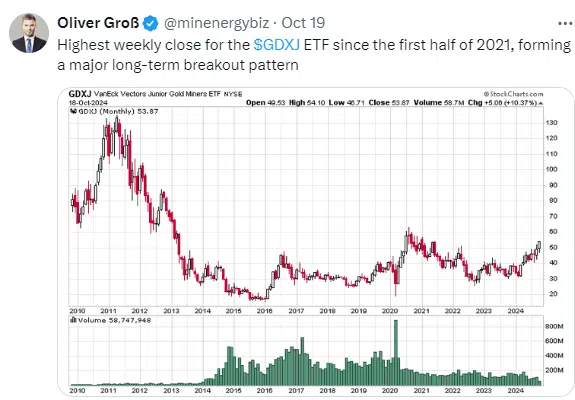

- One Piece To The Puzzle Still Missing

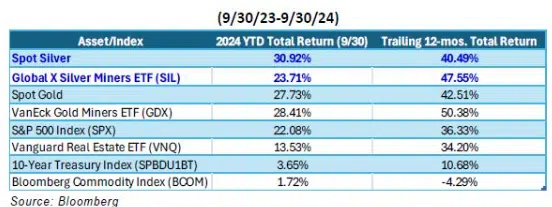

- We Are Going To Need A Bigger Boat

- Grandich Ten Commandments

As my 41st year in and around the financial arena is well underway, I find the vast majority of investors and the financial services industry at levels of complacency that go off the charts. Knowing I can toss many financial advisors off the top of the Empire State Building and all the way down they all will say the same thing, – “so far so good”, I have chosen to be the exception, not the rule.

This is my theme song:

Peace Be With You! – Peter Grandich

Grandich “X” Page here

Grandich YouTube Channel here