It’s my fondest wish to ride off into the sunset over the next few years, by holding onto the coattails of the most intelligent, hard-working, humble, and God-fearing man, I ever met in the metals and mining industry, Michael Gentile. Please watch here and here.

Three companies he’s a major investor in, have seen great success on the corporate development side of things since I first became involved with them, and all appear to have even better times ahead (In my highly bias personal view). Their technical trading status suggests there may be one-last quality entry point, and all are serious takeover candidates. They are not stock recommendations! I’m just sharing what I plan on doing for my own greedy, self-interest!

Michael’s and the company CEO’s recent comments can be found here.

Group Eleven Resources (GRLVF, ZNG) – Michael stated a few months ago that the company made the best discovery that no one seem to know about at the time. Most recent drill results gave every indication the high expectations MG had based on that initial discovery, were indeed correct. With Glencore a major shareholder (along with MG), who is also a big-time neighbor to their projects, suggests to me any further results that demonstrate both size, depth, and grade potential we’re already speculating on, would give Glencore plenty of reason to come knocking. If fortunate enough to see a pullback to the breakout point around $.14 -$.16U.S., I will look to add to my position.

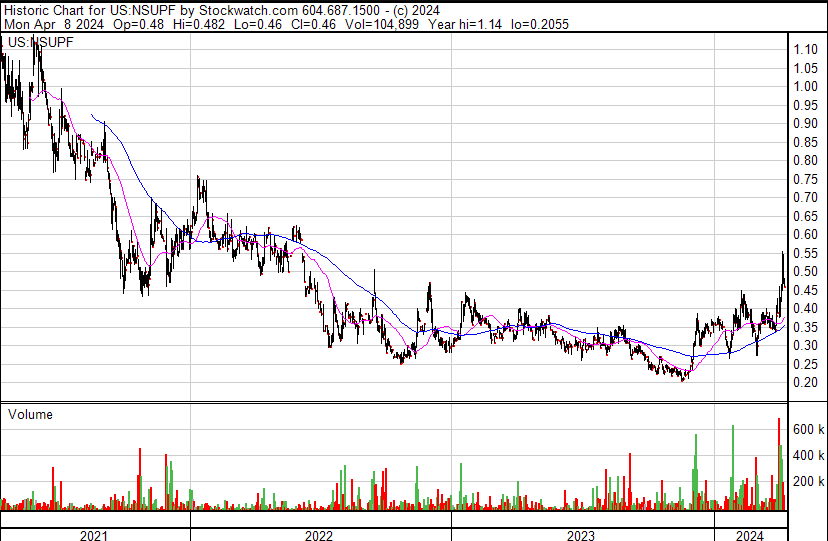

Northern Superior Resources (NSUPF, SUP) – The company has seen very little marketing/promotion as a major spinoff moves close to getting off the ground. I believe the beginning of trading of the spinoff will crank up the marketing of it, and it’s Mama. There are multiple reasons for a major to come after the company, and none have more reason to than IAMGOLD. While the company is already my second-largest holding, the breakout from an almost two-year basing, may or may not afford one last buying opportunity between $.40 -$.45U.S. for me to add to my position.

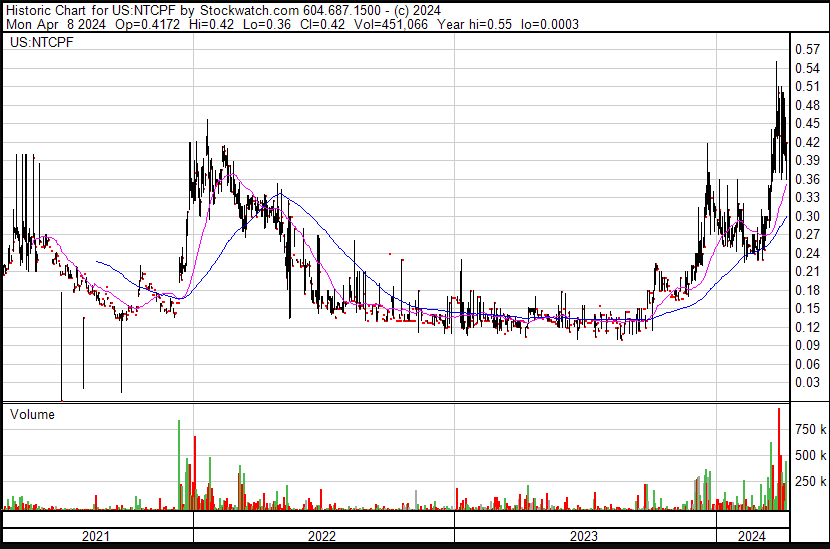

Northisle Copper & Gold (NTCPF, NCX) – None of my blog sponsor companies have performed better and made greater strides in their development than NCX. As usual, the results of drilling make or break a company. But when your CEO can walk and “talk” at the same time, so much the better. With Copper now on a most doable path to $5+, and the company’s much bigger and brighter picture from my first involvement having grown by leaps and bounds, I do believe they can see one or more knocks at the door before too-long. Looking to add between $.45 – $.50 U.S. if fortunated enough to do.

Please Note – A company MG is not involved in but is even a more likely takeover sooner than any of the above, is Amex Exploration. Here too, I’m very bias (blog sponsor and a fund I consult to has a large position), but I’m speculating that within 6 months of an initial MRE, they’re swallowed up.

Two worthy articles to read here and here.

Back in 2018, I was stating gold was in the early stages of a mega bull market. It was on either side of $1,200 an ounce at the time. By the end of 2021, I said for me, I would own no general equities other than those related to natural resources, or any bonds, and felt gold would outperform the stock and bond market for at least the next three years. In 2022, we saw it back around $1,650, and while the crowd said the “relic” was done and heading even lower, yours truly said to

While my target of $2,500 now appears quite reachable, I do think from this day on, mining shares and especially junior resource stock, can now outperform the metals themselves.

And yes:

So taking anywhere from 5% to 25% of huge gains in gold from here up to $2,500, and put it to work in the mining and exploration shares that still have considerable appeal, is what this “dinosaur” thinks is best to do with the “relic”. Silver is finally getting its act together, and I wouldn’t be adverse to putting some gold profits now into it.

Gold has indeed outperform stocks and bonds. Just remember how seemingly impossible that seemed when originally suggested.

Before becoming too deeply involved with mining shares, let’s not forget how some of us felt about them not too long ago:

I start my “Farewell Tour” this June, by returning to speaking at a mining conference in Quebec City. It’s my fondest wish if two other conferences I was honored to be a part in Vancouver for years, would have me back one more time. After that, there will only be one thing left to try and do:

Thank you, Jesus!